Looking to the Futures

Under Pressure

Federal Reserve Chair Jerome Powell will deliver remarks following the latest Federal Open Market Committee (FOMC) meeting. Rates are expected to be unchanged based on the CME FedWatch tool. The focus will be on the press conference as investors listen for guidance on future policy decisions and commentary on how current events may impact future interest rate decisions.

The Federal Reserve concludes its two-day policy meeting today and Federal Reserve Chair Jerome Powell will deliver the policy decision from January's session at 2:00 PM ET. Expectations are for interest rates to remain unchanged based on the CME FedWatch tool. The current probabilities reflect a 2.8% chance of a rate reduction. Looking out to the next Fed meeting, March 18, the probability of a rate reduction is 15.5%. Investors will listen to Fed Chair Powell's comments at the press conference for any hints of dovish or hawkish tone on key topics such as commentary on inflation, the labor market, and the actions of other Central Banks around the world. Traders will be monitoring closely for hawkish tones that could signal extended periods of volatility and increased risk.

March 10-Year U.S. Treasury Futures (/ZNH26) are trading slightly lower -0.03% to 111'225 ahead of today's policy decision. With March 5-Year (/ZFH26) and 30-year (/ZBH26) U.S. Treasury Futures also pointing down -0.01% and -0.15% ahead of the opening bell (As of 8:30 AM ET). The S&P 500 reached a new all-time high on Tuesday finishing up 0.41% to 6978.60 and March E-mini S&P 500 Index Futures are trading at 7020.50 and moved as high as 7043 overnight. Traders will be keeping an eye on tech earnings which continue today as various tech companies have earnings reports on the docket for today.

The Dollar Index ($DXY) is coming off its largest daily decline since April 10, 2025 and has been weak to start 2026 reaching a low Tuesday of 95.551. President Donald Trump was in Iowa to deliver a speech on the economy, made comments to reporters expressing no concern for the currency's decline. The dollar has been pressured by discussion over the acquisition of Greenland, concerns over Fed Independence, Tariff threats against the European Union (EU) and Canada, speculation over US-Japan currency intervention which would strengthen the Yen versus the dollar, and hovering risk of another partial government shutdown.

Meanwhile, the weaker dollar could be helping to support metal prices by driving demand. Silver future prices were in the hands of the buyers all of 2025 and the bull run has continued in 2026. Since the start of 2025, Silver Futures are up 277%, and 59% year-to-date. March Silver Futures (SIH26) are currently trading at 114.23 per troy ounce, up 7.81% (As of 8:30 AM ET). While Gold Futures have not experienced the same gains, gold is still pushing new highs. Overnight March Gold(/GCH26) reached a new high of 5345 per troy ounce and is currently trading for 5298.2 up 3.48% from yesterday's settlement (As of 8:30 AM ET).

Technicals

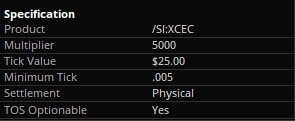

Since the metals have been the center of attention, March Silver Futures (/SIH26) continue extending the bull run, reaching a new high Monday of 117.7. Yesterday, Silver gave back the gains from the prior day and rebounded overnight for the Wednesday session. Silver futures are still in a strong uptrend with the distance between the 21-day exponential moving average (EMA) and the 50-day simple moving average (SMA) is growing. Volatility is on the high-end, compared to the previous 6 months. Silver has broken out after consolidating from January 15 to 22, breaking out January 23 to reach Monday's high. Volatility has been noticeable in metal products, silver futures are just off the 6-month high for volatility of 1.2028 (120.28%), currently 1.0227 (102.27%). Trading Monday was the highest when compared to the previous 6 months. 312,346 contracts were traded on Monday, and the 50-day average volume is 129,670 contracts. Silver has a relative strength index (RSI) of 71.0401, which is still just above the 70-overbought level, indicating that buying pressure is still present.

Details for Silver Futures (/SI) Indicators

9-day SMA - 100.164

21-day EMA - 90.717

50-day SMA - 71.508

Volatility - 1.0227

RSI - 71.79

Specifications

Major economic reports, trading events, and news items that could potentially impact specific futures markets:

- MBA Mortgage Applications 7:00 AM ET

- Intl. Trade in Goods – Delayed 8:30 AM ET

- Retail/Wholesale Inventories – Delayed 8:30 AM ET

- Oil Inventories 10:30 AM ET

- FOMC Announcement 2:00 PM ET

- Fed Chair Powell Presser 2:30 PM ET

New Products

New futures products are available to trade with a futures-approved account on all thinkorswim platforms:

- Ripple (/XRP)

- Micro Ripple (/MXP)

- Micro Corn (/MZC)

- Micro Wheat (/MZW)

- Micro Soybean (/MZS)

- Micro Soybean Oil Futures (/MZL)

- Micro Soybean Meal Futures (/MZM)

- 1 OZ Gold (/1OZ)

- Solana (/SOL)

- Micro Solana (/MSL)

Visit the Schwab.com Futures Markets page to explore the wide variety of futures contracts available for trading through Charles Schwab Futures and Forex LLC.